Trove's Referral Program Exposed: Yay to More Money!

What Trove users didn't tell us about their investments...or maybe they didn't have a clue

Trove users have been literally sitting on a goldmine all this time. But here’s the most upsetting part: they probably don't even know it.

The good news is that you're different.

Together we're going to approach the Trove referral program with a lot more intelligence and tact than probably the person whose referral code we used to sign up.

Yay to more money! 💰

Here are some things you’re expected to learn at the end of this newsletter:

How to not get carried away by the figures and focus on the strategies that make you more money

How to make extra money from your Trove app

How to calculate the annual dividend you can get from a company that pays dividend

How to properly analyze your potential gain from referral programs

How to effectively gain more conversions from sharing your referral link

But in return my challenge to you is to take a screenshot of the part of this newsletter that you found insightful and tag me @mary_imasuen (on Twitter or Instagram) with the hashtag #RelishAbundance.

Deal?

Well, since this is my first newsletter, you might as well know a little about me.

I'm Mary Victoria and I love fintech — more the apps than the regulations — and I find it fascinating that an application you download to your phone or use on a web browser has the potential to make you wealthy.

And what I discovered over the weekend is a perfect example of how these fintech apps play out.

Allow me to veer off for a minute…

Honestly, it all started off as a joke.

Never did I imagine that it'll lead me to tear apart Trove's referral program.

Last Saturday I watched Fisayo Fosudo’s video about the saving strategies he used to save $20,000 in less than 6 months.

Before you get too excited about the $20,000, let me point out that:

He lives in Nigeria and has foreign clients who pay in dollars. And we all know that the devaluation of the naira favours those in the gig economy right now.

He has multiple streams of income including ad revenue from his YouTube channel, brand deals and so on.

He applied the saving tips he shared consistently over a prolonged period of time.

I'm not saying all this to dash your dreams, I just want you to focus on what's important: the strategy behind accumulating the wealth and not how much was accumulated.

Not everyone’s circumstances are the same. So use the strategies and adopt them to your unique situation.

Personal finance is a personal experience.

And those figures did their part by pulling you in and getting you curious enough to click the link.

I used a similar technique when I recorded my podcast episode titled “How I Saved Almost Half A Million Naira in PiggyVest in 16 Months”.

That episode attracted the highest number of plays so far.

But I digress…

The gem in the video

There was something in the Fisayo’s video that caught my attention — Trove's referral program.

Trove is a brokerage platform in Nigeria. Through the app you can buy both foreign stocks from companies like Tesla or Amazon and local stocks from companies in Nigeria.

What was peculiar about their referral program is that using someone's referral code gives you free stocks.

So when Fisayo mentioned that in his video, I dived right in, downloaded the app and used his referral code. All because I wanted to get free stocks. (Like why not?)

The next day, I posted how my only reason for downloading Trove was for the free stocks.

It was meant to be for laughs.

But it wasn't until a friend of mine asked me how Trove was like, that I realized that not many people knew about the potential of earning extra money just by getting people to register using your code.

She had previously downloaded the app, but never used it.

So, I told her about the referral program as a way to encourage her to use her fintech app to make some extra cash pending when she decides to actively use it as an investment platform.

That was when I saw Trove's incentive:

“Invite your friends to Trove and you'll both get 5 shares of either Dangote Sugar or GT Bank FOR FREE"

How you can make extra money from Trove and build your investment portfolio

After a bit of digging I realized just how valuable Trove’s simple offer was. Trove basically gives you 2 things for the price of one.

Allow me to explain.

Let's zoom in on Trove’s promise for referring your friends to the app.

If you already have Trove installed on your phone, you can find information about the referral program when you tap on the menu bar on your dashboard, and then tap on ‘Get Free Shares’.

Trove was very specific about what they're willing to offer you for getting a friend to sign up using your referral code.

They were so specific that they mentioned the exact companies the stocks will come from.

This wasn't anything like what their American counterparts Robinhood and WeBull offer. They give you free stocks, quite alright, but they don't mention which ones.

For example Robinhood clearly mentioned that they choose each stock “randomly”.

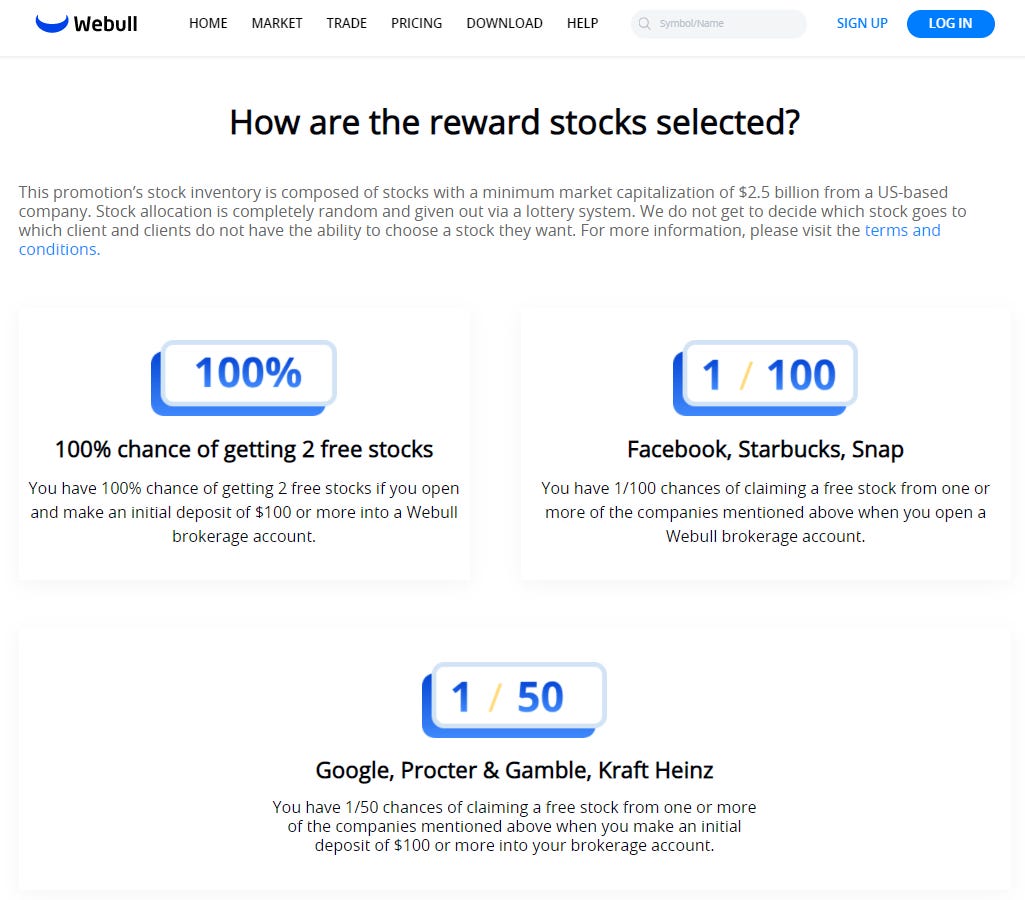

When you check WeBull they guarantee you'll get 2 free stock but what they don't guarantee is which ones.

You have 1/100 chance of getting a free stock from Facebook, Starbucks, or Snap and a 1/50 chance of getting Google, Procter & Gamble, or Kraft Heinz.

Now this is where things get interesting.

When you do a quick search of Dangote Sugar and GT Bank and how they're being traded in the stock market, you'll see that those companies offer dividends to their shareholders.

That's gold right there!

If you’re loving this newsletter, but you haven’t subscribed yet, drop your email below and hit ‘Subscribe’.

When a company on the stock market gives dividend, it means that they share the profits from the company with their shareholders.

Some companies pay dividends weekly, monthly, quarterly or yearly. So, when you invest in a company that gives dividend you're making passive income just by being an investor.

That means Trove's referral program does 2 things:

Helps you build your portfolio

Gives you passive income

Now let's do some math.

As at the time of writing this newsletter one share of Dangote Sugar was worth N17.80 with an annual dividend yield of 8.43%. GT Bank was worth N28.90 with an annual dividend yield of 10.34%.

The dividend yield is the percentage that is paid out as dividend per share.

So assuming you only had one share of any of the two companies within a 12 month period, you would have earned N1.50 for holding one unit of Dangote Sugar shares and N2.99 for one unit of GT Bank shares.

If you found the math confusing, please leave a comment so that I can help you understand it better.

It may look little at first glance, but there are infinite possibilities to how much you can make from this.

Just have a look at your potential earning from the dividends alone:

Dividends from Dangote Sugar

1 share of Dangote Sugar in 12 months = N1.50 as dividend

5 shares in 12 months = N7.50 as dividend

10 shares = N15

20 shares = N30

50 shares = N75

100 shares = N150

Dividends from GT Bank

1 share of GT Bank in 12 months = N2.99 as dividend

5 shares in 12 months = N14.95 as dividend

10 shares = N29.90

20 shares = N59.80

50 shares = N149.50

100 shares = N299

You get the picture?

And that's just the dividend!

And that’s all passive!

And you've not even added the value of the stock itself to it yet.

Let's say at the end of 12 months you only have 10 shares of GT Bank and that the price of one share remains the same during those 12 months. The total value of your GT Bank shares including the dividend will be N318.90.

That’s (10 shares of GT Bank x Price of GT Bank stock) + Dividend for 10 shares = Total value of 10 GT Bank shares including dividend for a period of 12 months (assuming the price of one share remains the same during those 12 months)

[(10 x N28.90) + N29.90] = N318.90

Now imagine going at this same pace for 3 years. Assuming the price of GT Bank shares remain the same throughout those 3 years and you don't add more of the same share in your portfolio, you'd have N956.70.

That’s Total value of 10 GT Bank shares including dividend for a period of 12 months (assuming the price of one share remains the same during those 12 months) x 3 years

N318.90 x 3 = N956.70

Of course, the price of the shares won't remain the same.

The stock market has a history of making an average of 10% return every year. Meaning that the value of the shares will increase over time.

So, the more people who use your referral code to sign up on Trove the more money you make, because those companies will continue to pay dividend.

It's mind-blowing!

Most investors keep reinvesting the dividends to grow their portfolio until it gets to a point they can literally live on the dividends.

I started off investing in stocks using Bamboo (a brokerage app like Trove) and up until a couple of weeks ago they weren’t promoting their referral program.

Bamboo's current referral program gives you 2.5% commissions from the first stocks your friend buys that is above $20 if they used your referral code to sign up.

And that's it.

You're not making anything more from the referral. In fact, you'll have to do extra convincing to get your friend to buy more than $20 worth of shares especially if they're newbie investors.

And that's why I found Trove's referral program exciting.

Where do we go from here?

Some of those who will read this newsletter actually have a Trove account. And the app is probably just lying in the midst of the barrage of more “interesting" apps in their phones. It sits there hoping that one day it'll get noticed.

If that's you, then you're leaving a lot of money on the table.

And it's understandable.

Very few people will actually do the math to ascertain just how profitable the referral program is.

And I bet up until a couple of minutes ago, you never knew any math could be involved.

Maybe you were among those who knew about the referral code and mentioned it to a couple of friends.

Maybe you posted it in blog posts, YouTube videos, newsletters, or anywhere that will give the 6 digit alphanumeric code some love.

Maybe you did what you had to do to make more people sign up to the app but didn’t just know how to market its benefits well enough to get them interested.

If that’s you, then start off by letting people know that the referral program isn't one-sided. Trove rewards both you and the one who used the code to sign up.

You both

get 5 stocks each,

receive stocks are from companies that give dividend, and

enjoy the dividends that are paid monthly.

And if you’re among those who don’t have Trove yet and you want to start off with 5 free stocks from Dangote Sugar or GT Bank, here’s my referral code: AKNR6U.

As for those who aren’t an ounce interested in Trove or their referral program, I hope this newsletter inspired you to look deeper into the kind of fintech apps you have in your phone.

Trove is just one out of the several fintech apps that have referral programs you can benefit from. I encourage you to explore them just as I did.

And if you’ve been thinking of investing but weren’t sure what kind of stocks to look out for, I pray that you go for dividend stocks because of the potential of earning passive income involved.

The Money is really hidden in the details, and the details are right under your nose. This is one of them.

Keep shining,

Mary Victoria 💋

P.S.

It'll mean a lot if you could share your thoughts in the comments.

And if you found this newsletter helpful or insightful, please share with with friend.

And if somehow you found your way to this place without subscribing, don’t leave without dropping your email and hitting the ‘Subscribe’ button.

Read it till the very end and I'm signing up on Trove right away.

Very educating and insightful.

You also explained it so well and made it easy to understand.

I look forward to reading more Newsletters from you.

Hi Mary, I know you’re a techie but you really know how to simplify things for just about a five-year-old to read and understand. Trove here we come🤗